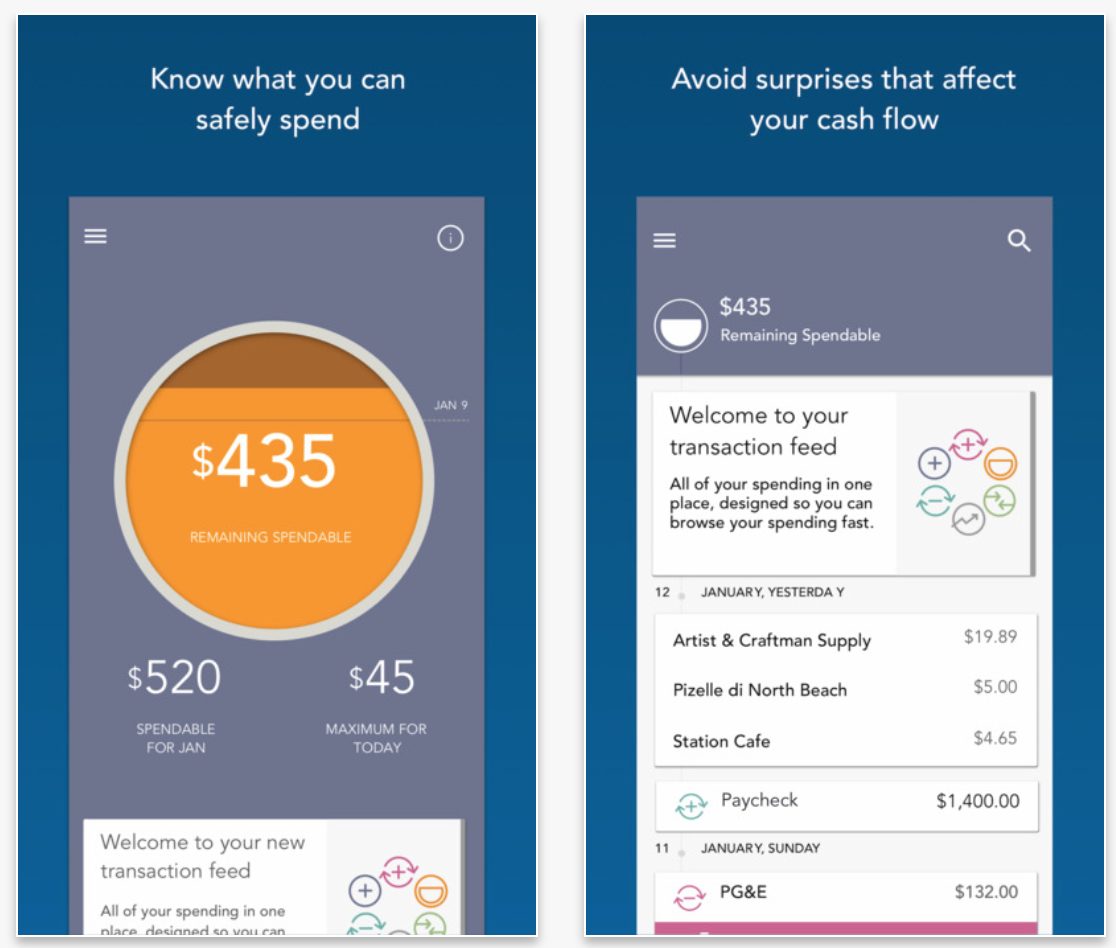

Level allows you (in theory) to exclude income, but the language is confusing Moreover, I had no idea where it was even getting this number, and there was nowhere I could go within the Level app for it to tell me. Level, however, did, and the numbers it was giving me bore absolutely no resemblance to the amount I knew I had to spend on everyday things. But much of that extra income was already flagged for certain purchases or for savings (for instance, much of my smallish tax refund would go to pay for using TurboTax to file three returns and for paying my federal tax bill, and half of the Digit money had long been meant for the iPhone), and I didn’t consider any of it part of my “spendable” as I conceived it. Thus March was an exceptionally unrepresentative month, in terms of both my income and my spending. Oh, and I had to replace my windshield, and pay to get my car inspected and registered in Maine. Part of that I used to buy a new iPhone, a long-planned purchase, and with some of my freelance money, I bought a DSLR, a birthday gift to myself. I closed my Digit account, so the almost $1,000 I had there got dumped back into my checking account. I had more freelance income than normal, as well as tax refunds from two different states, and birthday money from my mother. I’ll admit, March wasn’t the best month to start a new expense tracking app. Level can’t handle more complex (or unusual) financial situations Then it will tell you how much you have to spend for the day, the week, and the month. From that plan, Level determines your “spendable” money-i.e. (Level seems to only do this about once a day-a strangely sluggish schedule in the world of real-time updates.) Level also has you create a “plan” where you enter your expected monthly income, your bills, and your savings. Level, like Prosper Daily, has you connect your various accounts-checking, savings, and credit cards-and then downloads your transactions.

In its mechanics, Level works like a lot of other apps If an app requires constant fiddling, it’s not that helpful.

In sum, I never trusted the numbers Level gave me.Level allows you (in theory) to exclude income, but the language is confusing.Level can’t handle more complex (or unusual) financial situations.In its mechanics, Level works like a lot of other apps.

0 kommentar(er)

0 kommentar(er)